Want to learn more about Build your Portfolio?

What are Diversified Investment examples?

Why diversify?

What is the relationship between risk and return?

What is volatility or risk?

What is an asset class?

How to choose between actively managed and passively managed funds?

What is a benchmark index and which ones do we use?

What is the Maximum Drawdown of an investment fund?

What are Diversified Investment examples?

They are sets of investment funds selected on the basis of different levels of risk or volatility. Each example consists of funds investing in different asset classes and markets.

Why diversify?

To reduce the risk of your investment. Each example consists of funds that behave differently in different market situations, looking to balance return and risk, so that the return does not just depend on the performance of a single asset.

What is the relationship between risk and return?

Normally, the greater the risk the greater the return and vice versa. Strategies that are riskier have more pronounced upward and downward movements, and those that can be considered "safer" potentially offer lower returns but also lower losses. Diversification reduces the risk while maintaining an adequate expected return.

What is volatility or risk?

It is a variable that measures the frequency and intensity of changes in the price of an asset or in the financial markets. This variable quantifies risk over a certain time period.

What is an asset class?

It is a way of grouping together instruments based on their characteristics and behaviour. At Openbank, we offer the following asset classes:

- Liquidity and monetary assets.

- Fixed income, comprised mainly of bonds.

- Equity, composed mainly of shares listed on the stock exchange.

- Real assets that are linked to the real economy and which provide greater diversification (real estate assets, inflation-linked bonds, commodities (raw materials) and infrastructure).

How to choose between actively managed and passively managed funds?

There are many differences between passively managed funds and actively managed funds, but one of the main ones is the cost to the investor: passively managed funds have lower costs than actively managed funds. This lower cost does not imply that, with the same strategy, they offer a higher return.

To help you make a decision, this is why this cost difference between the two management types exists:

-

Costs of passive management: these are low because passively managed funds replicate indexes and, using different techniques, this form of management can be inexpensive for the fund manager. For an investor it would be more difficult to create a diversified portfolio like that of an index and still have the low costs of a passively managed fund.

-

Costs of active management: actively managed funds try to beat their benchmark indexes, achieving a risk-adjusted long-term return, and to do this, the managers must analyse the financial markets, build a vision of the future, bet actively against the indexes, etc., to try to anticipate the behaviour of the markets, exploit their inefficiencies and, thus, achieve a greater return.

When comparing the results of some funds with others, keep in mind that:

-

Passive management makes sense as a way to obtain the market beta (sensitivity to the movements in the benchmark index; for example, beta 1 means behaving like the indexes).

-

Active management makes sense as a way of obtaining a positive alpha (extra return between a fund and its index). Therefore, the important thing in active management is to consistently beat the benchmark index. This is possible for the leading managers in each asset class.

What is a benchmark index and which ones do we use?

A benchmark index can be used to gauge the performance of your investment, in terms of return and risk, for both an instrument and a set of instruments. At Openbank, we use the following ETFs (listed investment funds) as benchmark indexes for each asset and sub-asset class of Built your Portfolio:

- For Money Market, the benchmark index is iShares eb.rexx® Government Germany 0-1yr UCITS ETF, with ISIN DE000A0Q4RZ9.

- For Fixed Income – European Government Bonds, the benchmark index is iShares Core € Govt Bond UCITS ETF, with ISIN IE00B4WXJJ64.

- For Fixed Income – Global Government Bonds, the benchmark index is iShares Global Govt Bond UCITS ETF EUR Hedged, with ISIN IE00BKT6FT27.

- For Fixed Income – European Investment Grade Corporate Bonds, the benchmark index is iShares Core € Corp Bond UCITS ETF, with ISIN IE00B3F81R35.

- For Fixed Income – US Investment Grade Corporate Bonds, the benchmark index is iShares $ Corporate Bond UCITS ETF EUR Hedged, with ISIN IE00BF3N6Y61.

- For Fixed Income – Emerging Market Bonds, the benchmark index is iShares J.P. Morgan $ EM Bd UCITS ETF EUR Hedged, with ISIN IE00B9M6RS56.

- For European Equity, the benchmark index is iShares MSCI Europe UCITS ETF, with ISIN IE00B1YZSC51.

- For North American Equity, the benchmark index is iShares MSCI North America UCITS ETF, with ISIN IE00B14X4M10.

- For North American Equity - Hedged (EURH), the benchmark index is iShares North America Index Fund EUR Hedged, with ISIN IE00BJVKFT58.

- For Japanese Equity, the benchmark index is ISHARES MSCI JAPAN UCITS ETF, with ISIN IE00B02KXH56.

- For Asian-Pacific Equity, the benchmark index is ISHARES MSCI PACIFIC EX-JAPAN UCITS ETF, with ISIN IE00B4WXJD03.

- For Emerging Market Equity, the benchmark index is iShares MSCI EM UCITS ETF, with ISIN IE00B0M63177.

- For Real Assets – Inflation-linked Bonds, the benchmark index is iShares € Inflation Linked Govt Bond UCITS ETF, with ISIN IE00B0M62X26

- For Real Assets – Inmobiliario, iShares Developed Markets Property Yield UCITS ETF, with ISIN: IE00B1FZS350 .

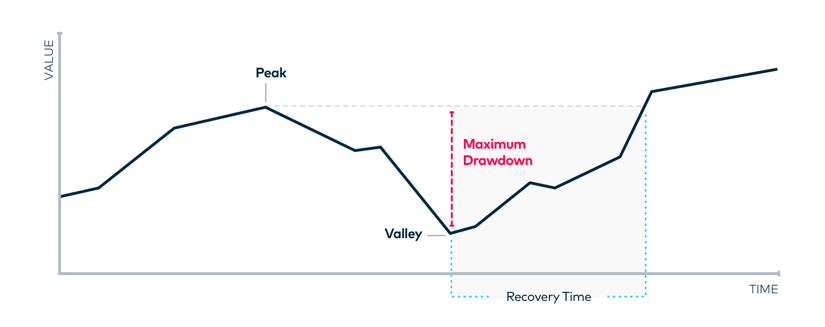

What is the Maximum Drawdown of an investment fund?

The Maximum Drawdown marks the maximum loss that the value of an investment fund can suffer in a given period of time. In other words, it is registered from an initial maximum ("peak") to a minimum ("valley"), and the recovery time represents how long it takes until the value of the fund exceeds the initial maximum.

We make it simple. Give us a call on 91 117 33 16 or 900 10 29 38 and our team of investment specialists will be happy to help (Mon-Fri 8 a.m. to 8 p.m.).

Find us on: