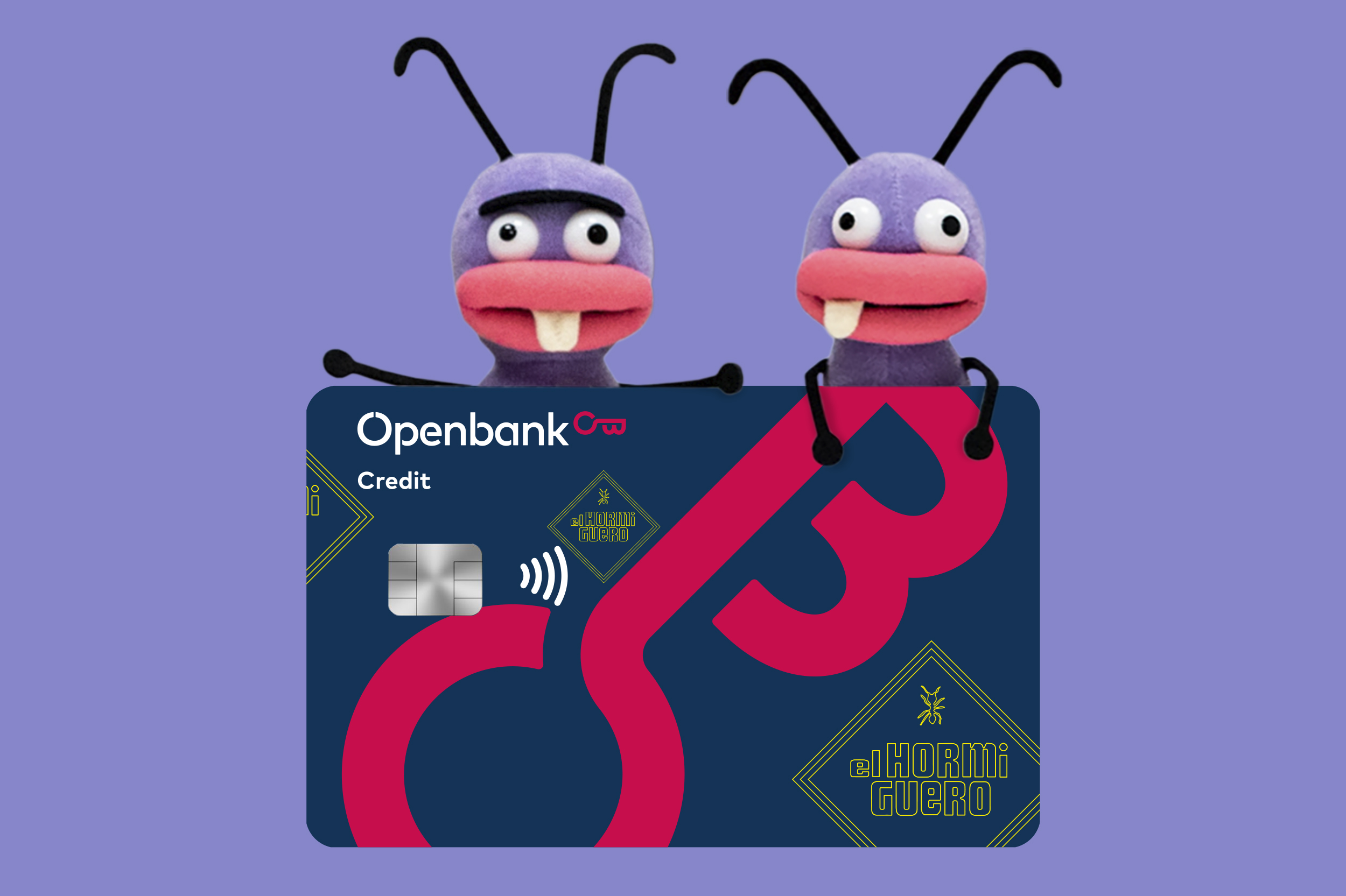

Openbank launches El Hormiguero credit card for clients and non-client

28/04/2022

Openbank, Grupo Santander’s 100% digital bank, expands its product range with the launch of its El Hormiguero credit card. This new payment instrument, available to customers and non-customers, boosts the bank’s strategy in the ‘buy now, pay later’ sector by giving users the option of financing purchases made with it for one month interest-free.

Any customer with a bank account, whether it is with Openbank or not, can apply for it in just a few minutes online and can use it without changing banks. The card is free for the first year, comes with the two renowned ants and has a renewal cost of €5 per year. In addition, this product allows payments to be financed for up to 36 months, with those financed for under one month being interest-free.

The card also offers the option of activating travel benefits for €7.99 per month. Users can enjoy benefits including five fee-free withdrawals per month at any ATM worldwide, fee-free purchases in any non-euro currency and access to accident insurance up to €100,000 and to travel assistance covering, for example, hospital costs, missed flight connections, repatriation, theft, baggage delays and legal costs. These benefits will be activated for however long customers decide. They can also be deactivated (and subsequently reactivated) when customers want with a single click on the website or app.

Additionally, as with all Openbank cards, their use is completely safe thanks to the Card Control platform. This platform allows customers to configure the channels or devices that use their cards, as well as to use the Password Manager Databank, which allows passwords and information to be saved, and an expense categorisation tool.

The new El Hormiguero card builds on the business strategy of the Digital Consumer Bank (the combined forces of Openbank and Santander Consumer Finance) in the ‘buy now, pay later’ business. In January, the bank launched Zinia, its digital consumer lending platform. It already has over two million customers in Germany and is set to expand over the coming months into several markets where Grupo Santander currently operates.

Press Kit

The latest news