PSD2

Online shopping with greater security

European Payment Services Directive (EU) 2015/2366, known as PSD2, includes several security measures affecting banks, merchants and consumers. These measures include improvements to offer consumers greater protection when making purchases online.

Previously, only single-factor authentication was required to verify online purchases. However, with the implementation of the PSD2, payment service providers must now use strong customer authentication (two-factor authentication or 2FA), which means verifying online transactions using 2 or 3 of the following factors:

- Knowledge factor: such as a passcode.

- Possession factor: such as an OTP sent by SMS.

- Inherence factor: such as a fingerprint or face recognition.

Below, we’ll show you how to change the way you verify your online purchases with your Openbank cards.

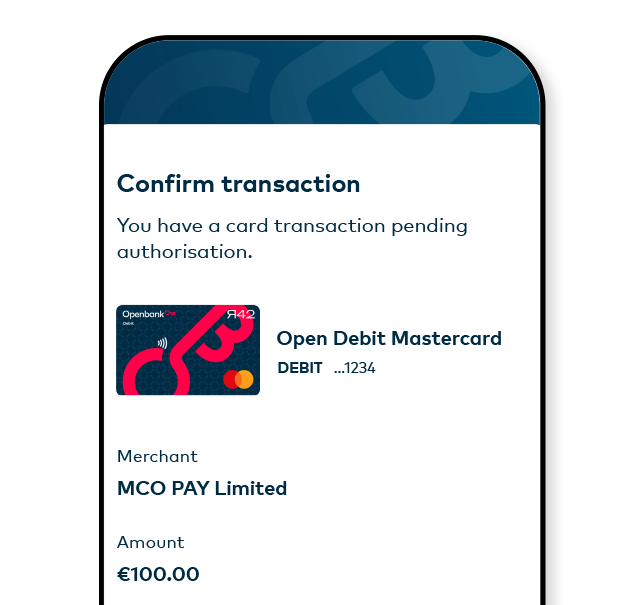

An extra step in your online shopping experience

* For example: if the SMS confirmation code is 4ABC and your 3D Secure Code is 1357, you will have to enter: 4ABC1357.

Adding a trusted device is now easier, but just as secure.

If your device has Touch ID or Face ID, you can confirm in a secure way that you are the cardholder without having to enter an SMS confirmation code or 3D Secure Code. Just add it as a trusted device following these simple steps:

- Log in to the Openbank app on your device.

- A message will pop up asking if you want to add it as a trusted device.

- Tap “Save” and follow the steps.

Bear in mind that there are exceptions to the directive that allow online purchases to be made without using a 3D Secure Code or trusted device. Furthermore, this directive does not apply to online purchases made outside the European Union.