Find out how to squeeze more out of your savings.

We’ve got different options to choose from.

There's more than one path that leads to the future you have in mind. Choose yours!

The first step to finding the best strategy for your savings is understanding your type of profile.

Neither of the two options.

I don't mind bearing risks.

Bear in mind that any investment carries some level of risk, including the lack of return, loss of invested capital and/or foreign exchange risk for non-euro-denominated products. The value of the investment is subject to market fluctuations and the return actually obtained may differ from that expressed in the Internal Rate of Return ("IRR") or APR due to potential changes in the assets held in the portfolio or the market performance of interest rates and issuer credit. This data is not a reliable indicator of future performance or the return actually obtained. Past performance is no guarantee of future results.

I don't want to bear much risk

Check out these options to earn returns on your money, with little to no risk.

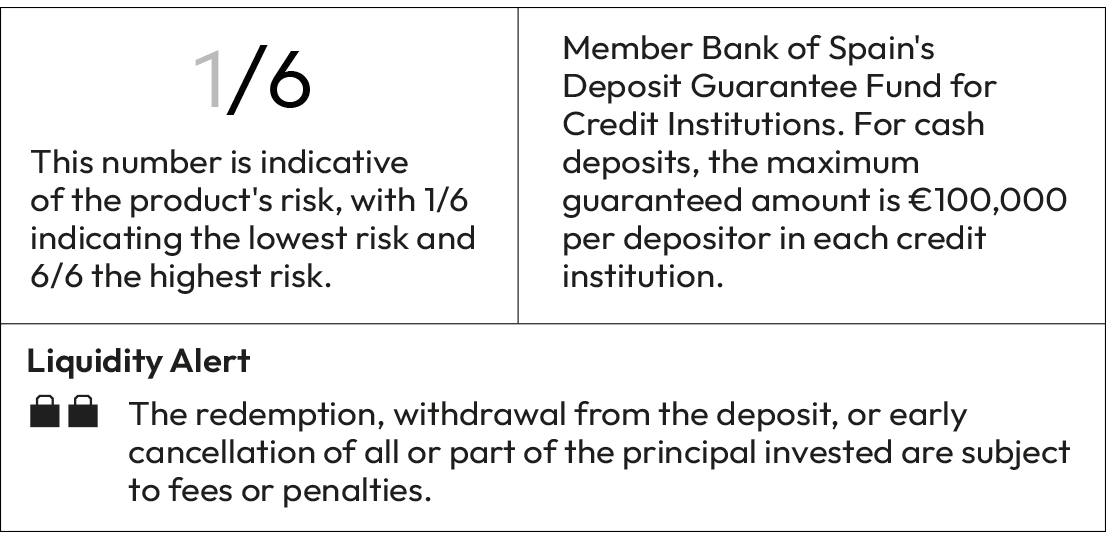

Fixed-term deposit

12-MONTH DEPOSIT FOR EXISTING FUNDS

Earn interest at up to 1.25% APR1 and 1.25% annual NIR on your existing funds at Openbank.

Low-risk fund

LA FRANÇAISE TRÉSORERIE

The internal rate of return (IRR) is 2.06%2 for the next 12 months. Data gross of fees and charges, which correspond to 0.33% of the total and are to be deducted from the IRR. The 2023 return was 3.36%, 3.80%2 in 2024, and in 2025 is 1.96%2. The unfavourable scenario2 based on past returns for a 10-year investment horizon is -0.38%.

You can earn a higher return by investing in this low-risk mutual fund that invests in debt and money market instruments of high credit quality.

Short-term corporate bond fund

EVLI SHORT CORPORATE BOND

The IRR (internal rate of return) of this fund is 3.47%2 for the next 12 months. Data gross of fees and charges, which correspond to 0.59% of the total investment, to be deducted from the IRR shown. The 2023 return was 7.44%, 5.47%2 in 2024, and in 2025 is 3.54%2. Unfavourable scenario2 based on past returns for a 10-year horizon: -2.90%.

The fund invests its assets primarily in euro-denominated bonds with a short and medium term remaining duration issued by European companies and banks with a sufficiently broad portfolio to diversify the risk.

By clicking “Find out more”, you will be taken to the information sheet for La Française Trésorerie Fund and Schroder Euro Corporate Bond ESG, where you can consult the 5-year return (or calculated from the fund's inception date, if less than 5 years old), among other details.

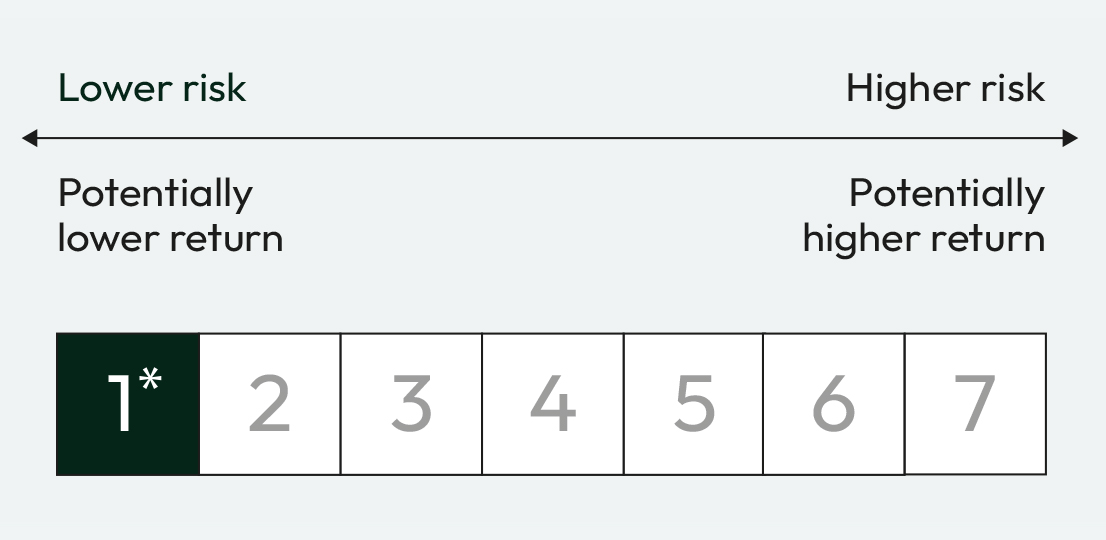

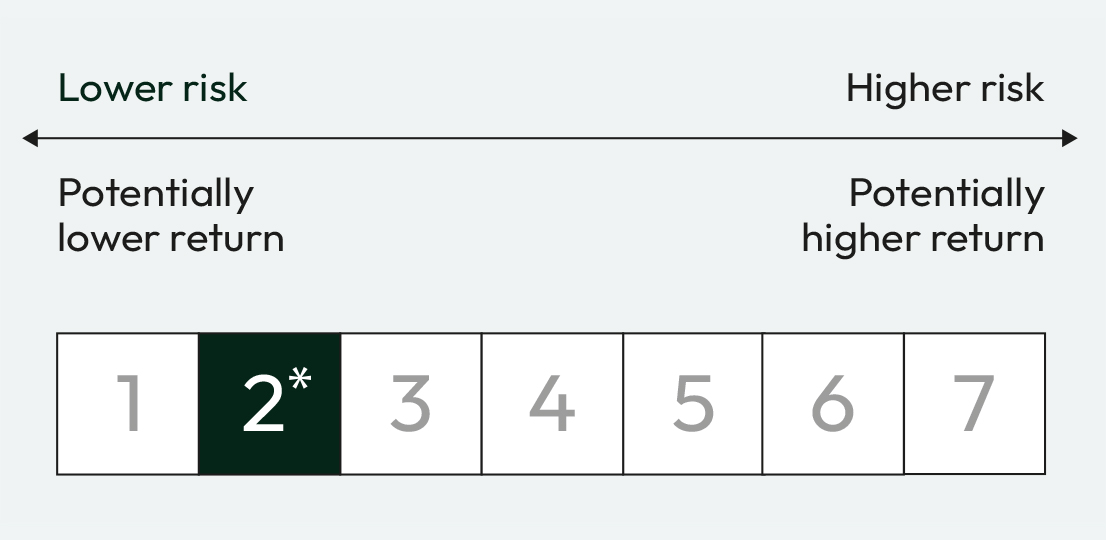

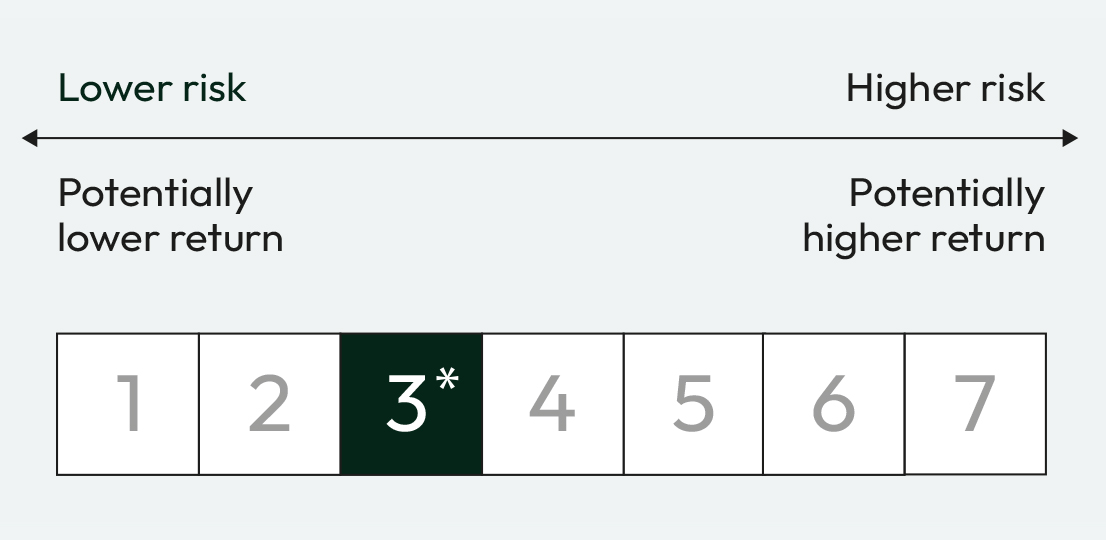

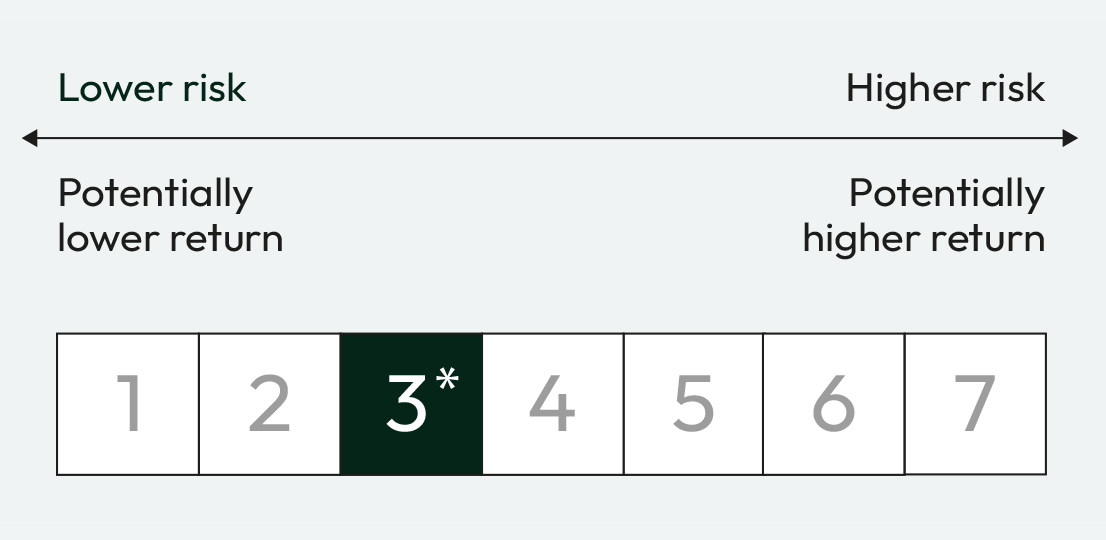

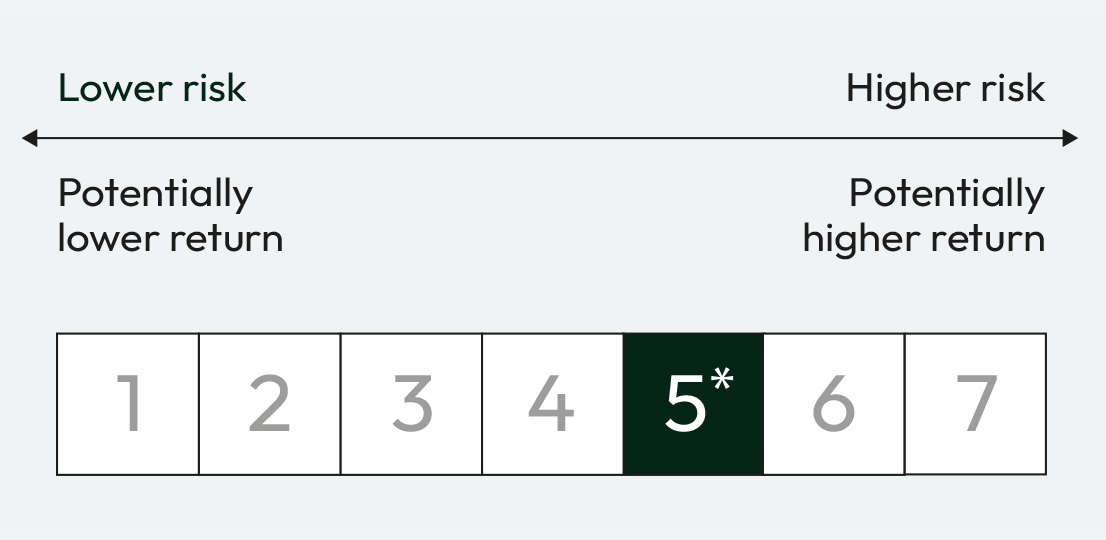

*Key Investor Information Document (KIID) risk scale. Risk rating 1 does not mean a risk-free investment. This indicator may change over time.

Neither of the two options

If you want to earn higher returns while taking on a moderate risk, check out these products.

European IG bond fund

SCHRODER EURO CORPORATE BOND ESG

The internal rate of return (IRR) is 3.45%2 for the next 12 months. Data gross of fees and charges, which correspond to 1.19% of the total and are to be deducted from the IRR.The 2023 return was 9.71%, 5.98%2 in 2024, and in 2025 is 3.50%2.

The unfavourable scenario2 based on past returns for a 10-year investment horizon is -6.6%.

It invests in a portfolio of euro-denominated bonds and other fixed income securities issued by companies, governments and public bodies. It ensures 80% of its net assets are invested in corporate bonds.

Medium-risk fund

INVESCO PAN EUROPEAN HIGH INCOME

This is an actively managed mixed-asset fund with flexible exposure to both corporate equities and debt securities. The asset allocation benchmark is 25% equities and 75% fixed income.

The fund follows environmental, social and good governance (ESG) criteria.

Diversified mixed-asset fund

GOLDMAN SACHS PATRIMONIAL AGGRESIVE

The fund invests in a wide variety of asset classes, especially global equities (75%) and euro-denominated fixed income (25%).

It also follows environmental, social and good governance (ESG) criteria.

By clicking “Find out more”, you will be taken to the information sheet for Mutuafondo, where you can consult the 5-year return (or calculated from the fund's inception date, if less than 5 years old), among other details.

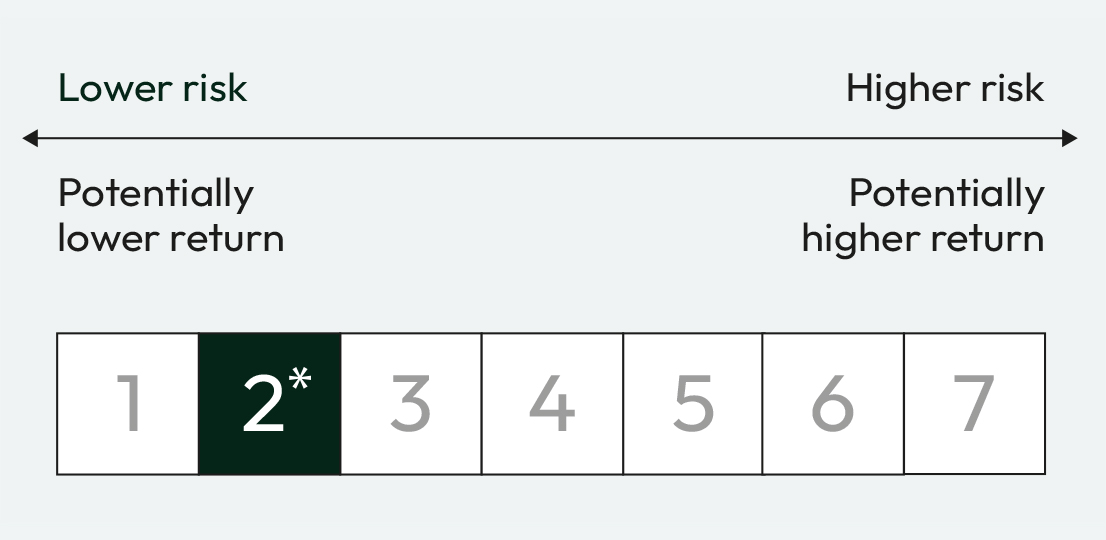

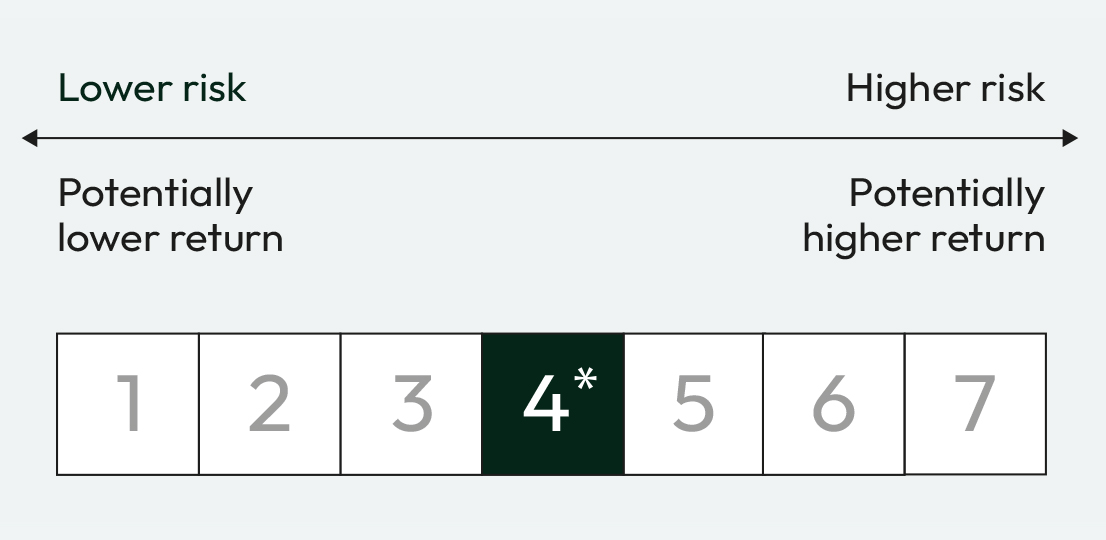

*Key Investor Information Document (KIID) risk scale. Risk rating 1 does not mean a risk-free investment. This indicator may change over time.

I don't mind bearing risks

A solid strategy if you're looking to earn the maximum potential return, even if it means bearing a higher risk.

Equity fund

ROBECO BP GLOBAL PREMIUM EQUITIES

This fund invests in approximately 100 of the top companies around the world and boosts your portfolio’s diversification. The selection of these stocks is based on their growth analysis and potential short-term returns.

The objective of this fund is to apply active management on the performance of the MSCI World Index, which is representative of the large and mid-cap markets of 23 developed countries.

US equity

JPMORGAN US SELECT EQUITY PLUS

Seeks long-term capital growth by investing primarily in securities of the most important US companies.

Its benchmark index is the S&P 500 Total Return .

Thematic fund

DWS INVEST ARTIFICIAL INTELLIGENCE

This thematic investment fund invests in companies around the world whose business stands to benefit from or be related to the progress of artificial intelligence, a technology that could be a key factor in global economic development in the years ahead. Its investment goal is to achieve long-term capital growth

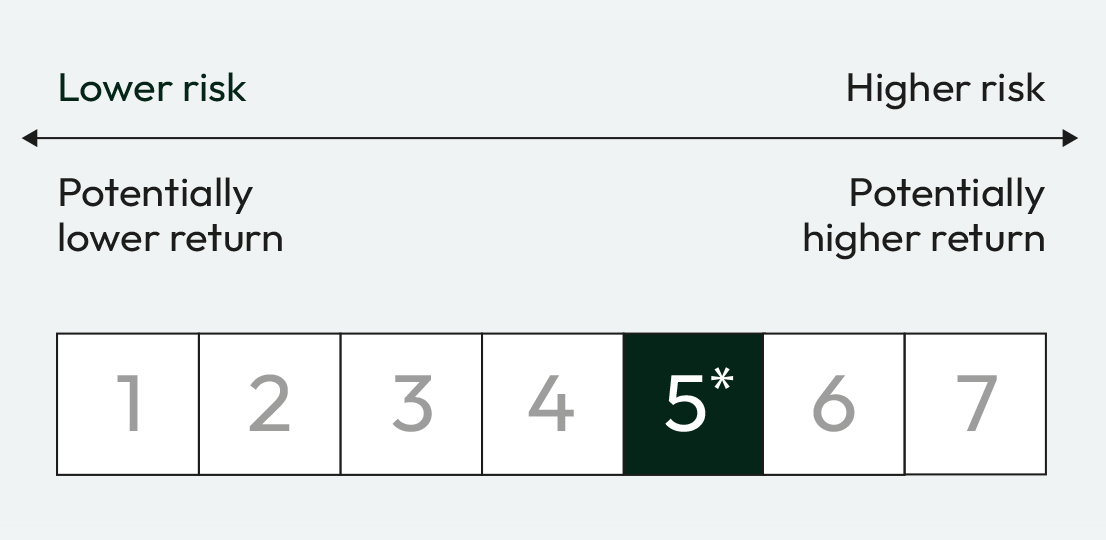

*Key Investor Information Document (KIID) risk scale. Risk rating 1 does not mean a risk-free investment. This indicator may change over time.

Invest in funds with no need to be an expert!

We make investing simple. Use our robo-advisor automated investment service and our experts will invest in fund portfolios for you. All you need to do is answer a few simple questions to determine your investor profile and then choose the strategy that works best for you. You can get started with an investment of just €500.

Choose between more than 3,000 investment funds in our catalogue using our Fund Finder

Before investing, please consult the level of risk and information for each of the investment funds marketed by Open Bank, S.A. in the Prospectus or Key Investor Information Document (KIID) for each one of the investment funds, available at www.openbank.es/en and www.cnmv.es.

This section is for information purposes only and does not intend to be exhaustive, not does it imply any kind of advice or recommendation by Open Bank, S.A. To confirm the information, please refer to official information sources or consult a professional. Open Bank, S.A. is exempt from any liability that may arise from the publication of this information.

1 Representative example of interest for the 12-Month Open Deposit with a balance of €25,000 and interest at 1.25% APR and annual NIR over 12 months paid at the end of the term: (i) If you comply with the 12-month term, the gross interest paid at maturity (at the end of the period) would be €312.50. (ii)If you decide to withdraw your savings early after only 6 months, 0.20% APR and annual NIR will be applied, and the gross interest would be €25.

2 Internal rate of return (IRR) expressed as the return for the next 12 months on the bond issues in which each of the funds invests, taking the principal and coupon payments (if any) into account. Bear in mind that the value shown should no be considered the sole value of the potential return on the investment obtained by the investor. This IRR figure is gross of investment fund fees and the fund's ongoing charges must be deducted. These include fees for purchasing and holding the fixed-income issues in which the fund invests, which are implicitly deducted from the fund's daily net asset value and are expressed as an annual percentage.

Source for return for funds: Refinitiv. The 2023 return refers to the period between 01/01/2023 and 31/12/2023. The 2024 return refers to the period between 01/01/2024 and 31/12/2024. The 2025 return refers to the period between 01/01/2025 and 10/11/2025. The returns shown are net of fees. IRR provided by asset manager on 31/10/25.

The unfavourable past performance scenario occurred between December 2019 and March 2020 for the La Française Trésorerie fund, April 2018 and March 2020 for the Evli Short Corporate Bond fund and July 2021 and April 2023 for the Schroders Euro Corporate Bond ESG fund, as set out in the funds' KIID respectively. Past performance is no guarantee of future results.

The APR and IRR of the investment funds are provided and reviewed by the asset managers at least once a month.

We make it simple. Give us a call on 91 117 33 16 or 900 10 29 38 and our team of investment specialists will be happy to help (Mon-Fri 8 a.m. to 8 p.m.).