Instant Transfers

Your transfers ... in a flash

Use our instant transfer service and send money to anywhere in Spain in 20 seconds. Your time is money!

Send and receive transfers within Spain in real time from the Openbank website and app. Service available 24 hours a day, 7 days a week.

Send instant transfers to any account in Spain or in any other European country free of charge.

Before sending the transfer, we check, through Iberpay, the transaction exchange platform for banks in Spain, that the payee account is valid and that the name of the payee and of the destination account holder is the same.

Send money by Bizum using the Openbank app!

Send and receive money instantly with Bizum. Just enter the recipient's mobile number - there's no need for account numbers. Activate the service for free on the Openbank app.

Want to learn more about Instant Transfers?

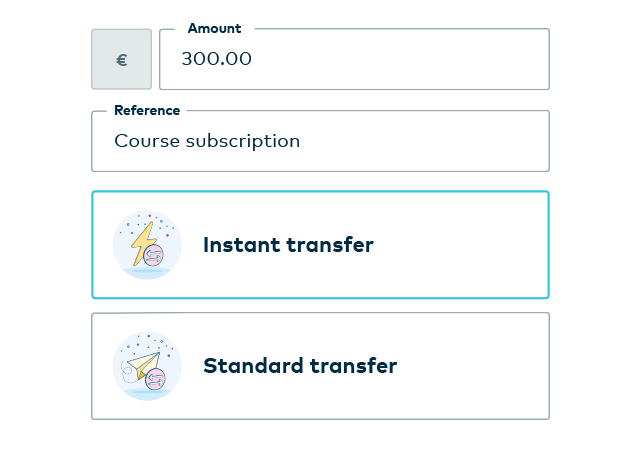

What is the difference between a standard transfer and an instant transfer?

The main difference is speed.

Instant transfers are cleared instantly, in real time, any time of day and any day of the week. Whereas standard transfers may take up to one business day, depending on the time and day the money is sent.

Does this service cost anything?

Instant transfers from any of your Openbank accounts are completely free.

What banks can instant transfers be sent to?

You can send and receive instant transfers to and from the majority of banks operating in Spain and in other European countries.

Can instant transfers be sent outside Spain?

Yes. At Openbank, you can send instant transfers to any account in Spain or in any other European country.

How long does an instant transfer take?

The technology we use is able to send these transfers in real time. The transfer may take up to 20 seconds to be completed.

Need any help?

For more information, email us at ayuda@openbank.es