Invest in Treasury Bills

Through investment funds at Openbank

What are Treasury Bills?

They are short-term fixed-income securities (normally with a 3, 6, 12 or 18-month maturity) issued by a government in an effort to secure financing. At Openbank, you can invest in treasury bills quickly and easily through investment funds.

Advantages of investing in Treasury Bills through investment funds

Treasury Bills

MUTUAFONDO DINERO

This fund invests exclusively in treasury bills and cash. Diversified portfolio with a minimum of 6 issues held at all times. No pre-fixed duration limit.

The average maturity of the fund’s portfolio is approximately 0.39 years2.

The internal rate of return (IRR) of this fund for the next 12 months is 2.36%2. Data is gross of fees and expenses, which in this case correspond to 0.42% of the total investment and are to be discounted from the IRR shown. The fund's return in 2023 was 2.63% and in 2024 was 3.25%2.

The unfavourable scenario2 based on past returns for a 10-year investment horizon is -1.31%.

RENTA4 FONDTESORO CORTO PLAZO

Short-term fixed income fund (euro-denominated) that mainly invests in assets issued or guaranteed by the Spanish Treasury (primarily treasury bills). The average duration of its portfolio will not exceed 12 months.

The average maturity of the fund’s portfolio is approximately 0.49 years2.

The internal rate of return (IRR) of this fund for the next 12 months is 2.49%2. Data is gross of fees and expenses, which in this case correspond to 0.51% of the total investment and are to be discounted from the IRR shown. The fund's return in 2023 was 2.60% and in 2024 was 3.31%2.

The unfavourable scenario2 based on past returns for a 10-year investment horizon is -1.82%.

BBVA FONDTESORO CORTO PLAZO

Short-term fixed income fund (euro-denominated) that mainly invests in assets issued or guaranteed by the Spanish Treasury (primarily treasury bills). The average duration of its portfolio will not exceed 12 months.

The average maturity of the fund’s portfolio is approximately 0.47 years2.

The internal rate of return (IRR) of this fund for the next 12 months is 2.4%2. Data is gross of fees and expenses, which in this case correspond to 0.76% of the total investment and are to be discounted from the IRR shown. The fund's return in 2023 was 2.37% and in 2024 was 2.99%2.

The unfavourable scenario2 based on past returns for a 10-year investment horizon is 1.40%.

By clicking “Find out more”, you will be taken to the information sheet for each Investment Fund, where you can consult the 5-year return (or calculated from the fund's inception date, if less than 5 years old), among other details.

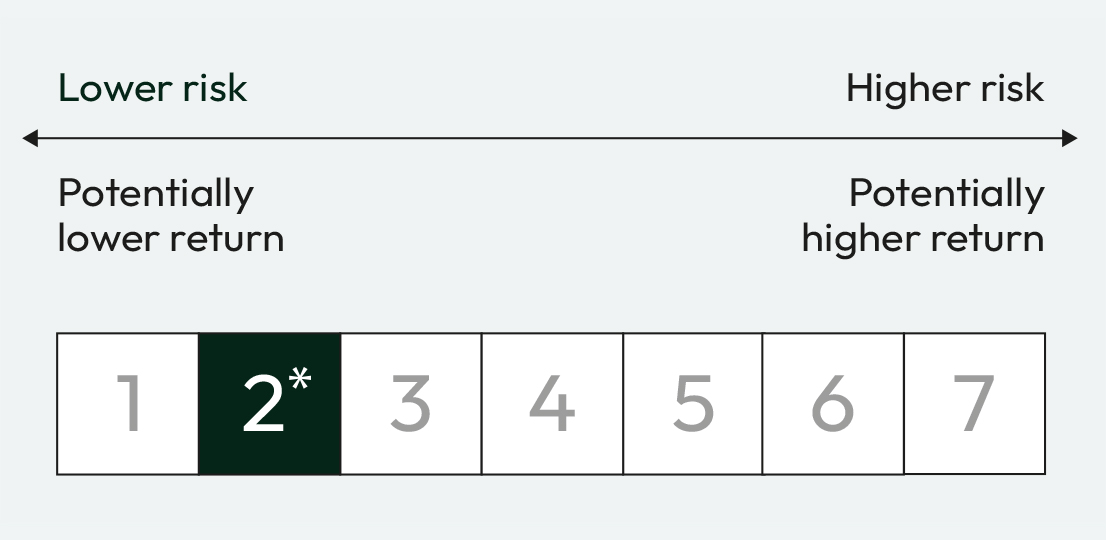

*Key Investor Information Document (KIID) risk scale. Risk rating 1 does not mean a risk-free investment. This indicator may change over time.

Other Target Return and short-term Fixed Income alternatives

LA FRANÇAISE TRÉSORERIE

You can earn a higher return by investing in this low-risk mutual fund that invests in debt and money market instruments of high credit quality.

The average maturity of the fund’s portfolio is approximately 0.06 years2.

The internal rate of return (IRR) of this fund for the next 12 months is 2.76%2. Data is gross of fees and expenses, which in this case correspond to 0.22% of the total investment and are to be discounted from the IRR shown. The fund's return in 2023 was 3.36% and in 2024 wast 3.80%2.

The unfavourable scenario2 based on past returns for a 10-year investment horizon is -0.38%.

GROUPAMA ENTREPRISES

This fund aims to outperform the eurozone money market, following the deduction of management fees. To this end, it makes short-term investments in liquid assets.

The average maturity of the fund’s portfolio is approximately 0.28 years2.

The internal rate of return (IRR) of this fund for the next 12 months is 2.57%2. Data is gross of fees and expenses, which in this case correspond to 0.34% of the total investment and are to be discounted from the IRR shown. The fund's return in 2023 was 3.25% and in 2024 was 3.73%2.

The unfavourable scenario2 based on past returns for a 10-year investment horizon is -0.65%.

CARMIGNAC SÉCURITÉ

The lion’s share of the fund’s portfolio is made up of bonds, debt securities or money market instruments, mainly demoninated in euros, as well as floating-rate bonds. The weighted average rating of the securities will be no lower than ‘investment grade’.

The average maturity of the fund’s portfolio is approximately 2 years2.

The internal rate of return (IRR) of this fund for the next 12 months is 3.68%2. Data is gross of fees and expenses, which in this case correspond to 1.25% of the total investment and are to be discounted from the IRR shown. The fund's return in 2023 was 4.06% and in 2024 was 5.28%2.

The unfavourable scenario2 based on past returns for a 10-year investment horizon is -3.20%.

By clicking “Find out more”, you will be taken to the information sheet for each Investment Fund, where you can consult the 5-year return (or calculated from the fund's inception date, if less than 5 years old), among other details.

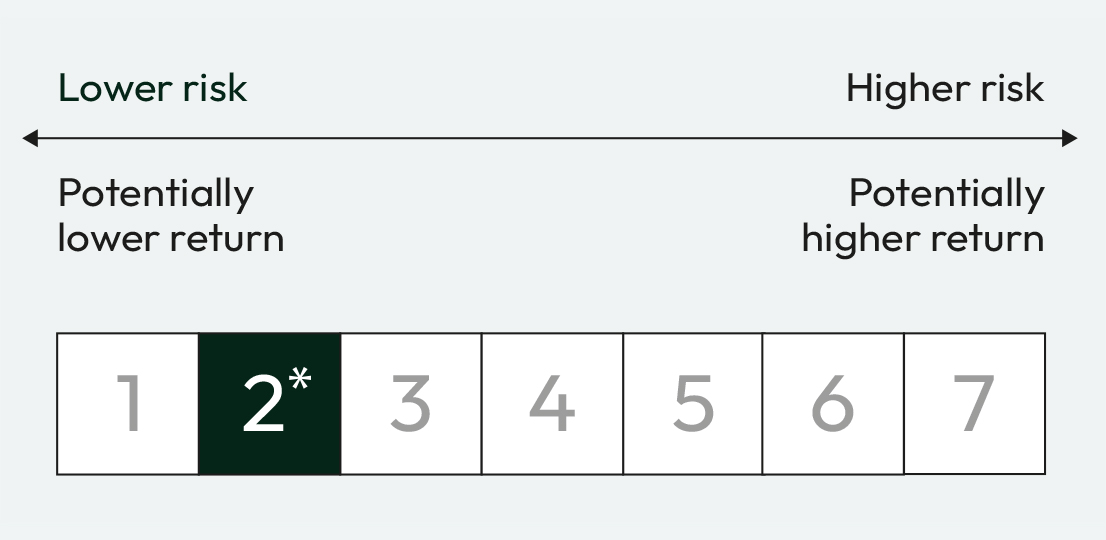

*Key Investor Information Document (KIID) risk scale. Risk rating 1 does not mean a risk-free investment. This indicator may change over time.

Please note that all investments bear some level of risk, including the lack of return, loss of invested capital and/or foreign exchange risk for non-euro-denominated products. The value of the investment is subject to market fluctuations and the return actually obtained may differ from that expressed in the Internal Rate of Return ("IRR") or APR due to potential changes in the assets held in the portfolio or the market performance of interest rates and issuer credit. This data is not a reliable indicator of future performance or the return actually obtained. Past performance is no guarantee of future results.

The level of risk and the information regarding each of the Investment Funds marketed by Open Bank, S.A. is detailed in the Prospectus or Key Investor Information Document (KIID) for each of the Investment Funds, available at www.openbank.es/en and www.cnmv.es.

1 Source: Tesoro Público [Spanish Treasury] - Results of latest Treasury Bill auctions.

2 Internal rate of return (IRR) expressed as the return for the next 12 months on the bond issues in which each of the funds invests, taking the principal and coupon payments (if any) into account. Bear in mind that the value shown should no be considered the sole value of the potential return on the investment obtained by the investor. This IRR figure is gross of investment fund fees and the fund's ongoing charges must be deducted. These include fees for purchasing and holding the fixed-income issues in which the fund invests, which are implicitly deducted from the fund's daily net asset value and are expressed as an annual percentage. Risk on a scale of 1 to 7. Risk rating 1 does not mean a risk-free investment.

Source for returns: Refinitiv. The 2023 return refers to the period between 01/01/2023 and 31/12/2023. The 2024 return refers to the period between 01/01/2023 and 31/12/2024. The returns shown are net of fees. IRR provided by the asset manager on 28/02/2025.

The unfavourable past performance scenario occurred between November 2017 and November 2018 for the Mutuafondo Dinero fund, September 2021 and September 2022 for the Renta 4 Fondtesoro Corto Plazo fund, September 2021 and September 2022 for the BBVA Fondtesoro Corto Plazo, December 2019 and March 2020 for the La Française Tresorerie fund, January 2022 and February 2022 for the Groupama Enterprises fund, and October 2020 and October 2022 for Carmignac Securité, as reflected in the funds’ KIIDs respectively. Past performance is no guarantee of future returns.

3 The ESTIMATED RETURN IS NOT GUARANTEED and the return actually obtained by the CIS may differ due to potential changes in the assets held in the portfolio or the market performance of interest rates and issuer credit.

APR, IRR and average maturity of the investment funds' portfolios are provided and reviewed by the asset managers and updated by Open Bank, S.A. at least once a month.

The information on this website is not intended to influence any decision of the recipient and does not represent a personalised recommendation of investment or advisory services, given that the financial situation, investment goals or other personal needs of the end investor, who is responsible for making a decision on their own investment based on the legal documentation of the Investment Funds prior to investing, have not been taken into account.

We make it simple. Give us a call on 91 117 33 16 or 900 10 29 38 and our team of investment specialists will be happy to help (Mon-Fri 8 a.m. to 8 p.m.).