The key? Travel+ ON mode!

What benefits does each card offer on your trips?

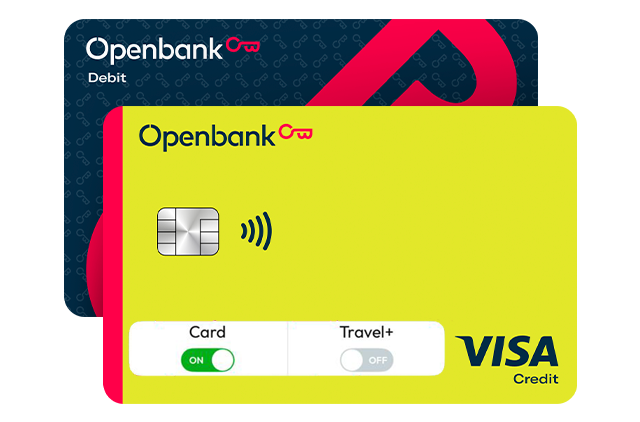

Take out our Open Credit Card!

- Pay in any currency, no matter when!

Whether you have Travel+ or not, you can pay in any currency, any day of the week, with no fees charged our end1. Weekends too!

- Travel+ Benefits for just €2.99/month

You’ll get 5 fee-free cash withdrawals a month at any ATM worldwide as well as travel insurance2 in the event of delays, damaged luggage, medical assistance, and more.

Or squeeze more out of the Open Debit Card!

- Passport at the ready!

It’s the go-to for your day-to-day purchases, and now you can switch your Travel+ benefits on to explore the world.

- Travel+ Benefits for just €4.99/month

You can pay in any currency, including weekends, with no fees charged our end3. Plus, you’ll get 2 fee-free cash withdrawals a month at any ATM worldwide.

Turn them into travel cards

on the website or app:

Turn them on in one click and enjoy their benefits for one month, even if you turn them off before the end of the month! Please note that if you do not turn them off, your monthly subscription will automatically roll over to the next month.

Go to the “Cards” section, choose the card4 you want to use on your trip and turn the Travel+ benefits ON.

Trips for your trips!

Always carry your physical card so you can withdraw cash at foreign ATMs.

And, whenever you can, we recommend paying and withdrawing cash in local currency. This means you will choose our exchange rate, which will likely work out cheaper for you.

That said, if you choose to pay in euros, the local bank will set the exchange rate, and it may be more expensive.

And if you are charged foreign exchange fees at the ATM by mistake, call us on 900 22 32 42 or +34 91 177 33 10 to sort it out. Remember, don’t forget that you can pay in any currency with no foreign exchange fees charged our end1 and 3, any day of the week!

Our travel cards are designed to travel the world!

Enjoy exclusive discounts as an Openbank account holder on hotels, flights, car hire and much more.

Some discounts are only available when you pay with your Openbank card, so don’t forget to pack it in your suitcase.

Bag discounts on brands such as Iberia, NH Hotels & Resorts, Pangea The Travel Store, Samsonite and plenty more.

With Card Control, you can choose the continents or countries in which your card can be used and the types of transactions made. For example, if you’re going to Mexico, you can enable your travel card to work exclusively in that country.

It’s easy to set up.

Just log in to the website or app. In the settings section of your card, select “Location”, and you’re all set!

You can get up to 35% cashback on Visa Cashback when you pay with your Openbank Visa card at participating retailers.

See the T&Cs and register on the Visa website in just 5 minutes. You can also check out all the brands where you're eligble for cashback on some of your expenses on your next trip.

More info

1 Visa may apply a mark-up to European Central Bank exchange rates.

2 Insurance taken out with Zurich Insurance PLC, Sucursal en España. View the full policy or summarised policy.

3 Mastercard may apply a mark-up to European Central Bank exchange rates.

4 Travel+ benefits are available on the following cards: Open Debit Card, Open Credit Card, Я42 Open Credit Travel Card, Openbank Reading Club Credit Card by Vanity Fair and El Hormiguero Credit Card.

Issuance of Openbank credit cards is subject to prior approval by the Openbank Risk Department.

*This link redirects you to the AIG website, so you’ll be leaving the Openbank page. Valid at participating merchants and subject to Visa terms and conditions. (https://cashback.visa.es/terminosycondiciones)

What cards are compatible with Travel+?

The Travel+ benefits are available on the following credit cards: Open Credit Card, Open Debit Card, Я42 Travel Card, Openbank Reading Club Card by Vanity Fair and El Hormiguero Credit Card.

Does Travel+ renew automatically?

Yes, it works like any other subscription. When you turn on Travel+, these benefits will last for a full month. If you don't turn them off, they will be automatically renewed on your credit card for €2.99/month and on your debit card for €4.99/month. You can turn them off whenever you want and they won't be renewed.

How long do the benefits last for?

Once you turn on Travel+, the benefits last for a full month and will be renewed automatically like a standard subscription.

If you turn Travel+ off before the end of the subscription month, you still have the right to enjoy the associated benefits until the end of the month, and they won't be renewed for the following month.

What does the free insurance include and what does the Travel+ insurance include?

The free insurance on our cards includes: travel accidents, which covers death or disability as a result of an accident as a passenger on public transport, provided that the trip has been paid for with the card. This insurance covers the cardholder and up to 5 people whose transport has been paid for with the cardholder's card, with a maximum compensation of €120,202. It also includes another accident insurance policy which, in the event of the death or disability of the cardholder as a result of an accident in their professional activity or daily life, would cover the payment of compensation of up to €6,010 equal to the sum of the invoices charged to the account for purchases made with the card in the last 12 months. And all this for free for using your card! With the guarantee of Santander Seguros y Reaseguros, Compañía Aseguradora, S.A.

See the full policy here.

If you activate the Travel+ benefits on your credit cards, you can enjoy travel assistance insurance with cover, among others, for flight delays, damage to luggage or international medical assistance. In addition, accident insurance on the means of transport used, provided the ticket was purchased with the card on which the travel benefits are activated, for death, partial or absolute permanent disability of up to €100,000, arranged with Zurich Insurance PLC, Sucursal en España.

See the full policy here.

Is foreign exchange covered?

You can use our credit cards to pay in any currency without exchange rate fees 24/7 ... regardless of whether your travel benefits are turned on or not.

As for the Open Debit Card, foreign exchange is covered only when you have the Travel+ benefits turned on.

Bear in mind that Visa may apply a mark-up to the European Central Bank exchange rate. See Visa exchange rates here and the Mastercard exchange rates here.

Is Travel+ automatically activated when I activate the card?

No, card activation is not linked to the activation of Travel+ benefits, i.e., you first activate the card and afterwards, if you want, you can turn on the travel benefits.

It's easy to turn on Travel+ benefits: just go to the "Cards" section on the website or app and click the "Travel+" button of the card on which you want to activate the benefits. When it turns green, your benefits will be ready to go.

What are the fees for withdrawing cash in a foreign currency?

If you activate Travel+, you can enjoy 5 free withdrawals per month worldwide (inside and outside the European Union) with your Open Credit Card, and 2 free withdrawals per month with your Open Debit Card.

We do not charge any fees our end or on the ATMs. However, the ATM may not differentiate between the amount of the withdrawal and the amount of the fee charged by the ATM. In this case, if your benefits are active and you are charged a fee for a cash withdrawal, please call us on us +34 91 177 33 10 or 900 22 32 42 so that we can look into this matter.

Credit cards

If you activate Travel+, you can enjoy 5 free withdrawals per month worldwide (inside and outside the European Union)*.

If you have Travel+ turned off, cash withdrawals in a foreign currency at national and EU ATMs are subject to fees of 3.90% of the amount you withdraw (minimum: €3.90), in addition to the fee charged by the ATM.

In the case of ATMs outside the EU, 4.5% of the amount you have withdrawn (minimum: €3), plus the fee charged by the ATM.

Open Debit Card

If you activate Travel+, you can enjoy 2 free withdrawals per month worldwide (inside and outside the European Union)*.

If you have Travel+ turned off, cash withdrawals in a foreign currency at national and EU ATMs are subject to fees of 4.50% of the amount you withdraw (minimum: €3.00), in addition to the fee charged by the ATM.

*We do not charge any fees our end or on the ATMs. However, the ATM may not differentiate between the amount of the withdrawal and the amount of the fee charged by the ATM. In this case, if your benefits are active and you are charged a fee for a cash withdrawal, please call us on us +34 91 177 33 10 or 900 22 32 42 so that we can look into this matter.