OPENBANK WEALTH

Who knew investing could be so easy?

You invest

More than 3,000 funds to invest in from as little as €1. No transfer, subscription, redemption or custody fees. Shares from the main stock markets, as well over 1,000 ETFs, Warrants and Pension Plans.

Choose a future for your money and we'll take care of the rest

With our robo-advisor automated investment service, all you need to do is answer a few simple questions. In under 5 minutes, you'll discover what kind of investor you are and find out which investment strategy is most in line with your profile. Our Investment Committee, advised by Santander Asset Management, will review the strategy on the basis of market developments and we will automatically rebelance your investment.

Plus, a team of AFI-certified specialists are always on hand to answer any questions before, during and after signing up to the service.

Check out our robo-advisor automated investment service

Want to invest but not sure how? We'll do it for you. Build your portfolio in less than 5 minutes and we'll automatically rebalance it in line with market developments.

Give it a go with an investment of at least €500. You can cancel the service whenever you want with no fees.

We manage your money by prioritising investment in funds that follow environmental, social and good governance criteria.

- Compare more 3,000 index and actively managed funds from over 130 asset managers.

- Fund finder and comparison tools.

- Buy shares from more than 25 stock markets with real-time updates for the Spanish market.

- Tools to keep track of your investments.

Build your diversified fund portfolio like a professional with no additional costs

We offer 5 diversified investment examples that reflect our market vision. You can replicate or adjust them according to your own vision, using actively managed or index funds. You can invest by transferring your funds or liquidity. Plus, if you prefer, we can invest for you.

What is Openbank Wealth?

This new space is divided into two sections, depending on how you want to invest:

Openbank Wealth is the new space devoted to the world of investment and financial markets where we keep you up to speed on the market vision of our investment committee.

- You invest: this is the section where you can find all the products we offer so that you can invest by yourself: stocks, investment funds, pension plans, ETFs and warrants. We also offer a complete toolkit to help you make the best investment decisions.

- We invest for you: our robo-advisor automated investment service is designed for anyone who wants to invest with no need to be an expert. A universal service with a minimum investment of just €500. How does it work? It's simple! All you need to do is discover your investor profile and then select the strategy you want us to follow. From then on, our Investment Committee, advised by BlackRock and Santander Asset Management experts, will analyse the market each month and, if it deems it appropriate, will automatically rebalance your portfolio.

Our robo-advisor, we invest for you service explained in 10 quick points

- Here’s a quick and simple rundown of the features of our "We invest for you" service:

- In order to be able to offer you the investment strategies that best suit you, we will ask you to answer a few short questions. You will then be able to choose the strategy you feel most comfortable with.

- You decide how much you want to invest; you can start with as little as €500. You can also schedule periodic contributions to gradually increase your portfolio from as little as €1. Please note that the order will be executed when the contributions add up to at least €10.

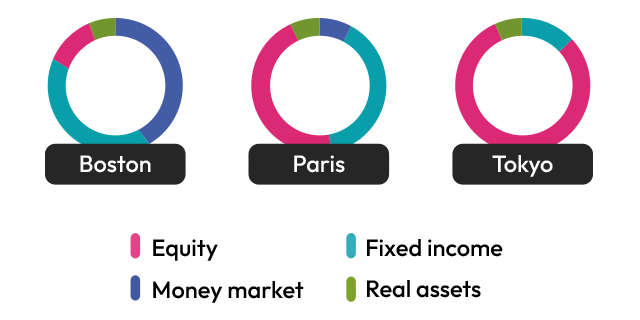

- Our Investment Committee makes investment decisions based on the diversification and risk of the investment strategy you have selected as well as market developments.

- We manage your money with the medium and long term in mind, investing in index and actively managed funds from the main asset managers, prioritising sustainable investment funds (ESG).

- The service automatically rebalances your investment portfolio by making transfers between funds, so there is no tax impact. This part of the management is automatic, which gives this type of service its name: Roboadvisor, from "robot" and "advisor".

- We engage the advisory services of BlackRock®, the world's largest asset manager, which offers us its market vision and asset allocation strategy, as well as Santander Asset Management, which helps us select funds.

- Once you have engaged the service, you will be able to monitor your portfolio or investment goal on the website and app 24/7.

- We keep you informed at all times about where we invest and how your money is performing. You have monthly reports and a tax report to help you with your taxes.

- You have a team of investment specialists on hand to help by calling 91 177 33 16. Our professionals have more than 20 years of experience and are certified by the AFI finance school.

- You can cancel the service at any time.

We invest for you is a service that is designed for a medium- to long-term investment horizon. At Openbank, we consider that a medium (3-7 years) or long term (more than 7 years) investment is the most efficient and optimal way to invest. This service can only be engaged by persons resident in Spain and by a single holder.

See the results of our automated investment service here.

1Source: Morningstar 2021.

Do you want to switch your investment funds to Openbank?

Please get in touch with our investment specialists on (+34) 91 177 33 16 – they will handle the transfer and you won’t be charged anything. Don’t forget that you will need your signature key (8 digits) to issue an order for the transfer. We also recommend having the following to hand:

- ISIN of the fund you wish to transfer and your Common Account Number in that fund. If the fund is international, we will ask you to provide the name of the bank or savings bank in which you hold the fund in order to identify the distributor.

- ISIN of the target fund. This must be a fund offered by Openbank. We have more than 3,000 index funds and actively managed funds to choose from, as well as funds with more accesible asset classes. Try using our Fund Finder to find one that suits you.

You will need to indicate if you are requesting a total or partial transfer (by amount or shares). Don’t forget that in order to process your transfer request, the holders of the source and target funds must match. This operation carries no fiscal implications and you will maintain the seniority of the transferred shares.

As soon as your funds are available in Openbank, you can carry out the following online and at no charge whatsoever:

- Purchase new funds.

- Additional subscriptions.

- Internal transfers.

- Redemptions.

Openbank does not charge any custody fees.

How can I transfer a plan from another company to Openbank?

To switch the pension plan you have at another company to Openbank, all you have to do is:

Print this document. Fill it in, sign it and send it to us by email, together with the last statement of the plan, to inversiones@openbank.es. Or, if you prefer, you can send it back to us by ordinary post to the following address (you don't need to buy a stamp - we provide you with a free postage label along with the plan transfer application document. You just have to print it, cut it out and stick it to an envelope):

Openbank

Operations/Product Department

Paseo de la Castellana nº 134

Madrid 28046

When we receive your application, we will contact the corresponding asset managers to start the process.

If you have any questions, send us an email to inversiones@openbank.es or call us on +34 91 177 33 16 and ask for one of our specialists.

How can you invest in a pension plan?

Our advanced Pension Plan Finder tool allows you to filter and select from between a wide range of plans, so you can find the pension plan that best suits your needs.

If you would prefer to speak to someone, call us on +34 91 177 33 16 and our team of pension professionals will be glad to help.

If you are not yet a customer, open an account by clicking here.

How can you invest in a fund?

You can invest right now from the Customer Area of this website. You can also invest through our app on your phone or tablet. Or call our investment specialists on 91 177 33 16 (Mon - Fri, 8 a.m. - 10 p.m.).

We make it simple. Give us a call on 91 117 33 16 or 900 10 29 38 and our team of investment specialists will be happy to help (Mon-Fri 8 a.m. to 8 p.m.).