Pension Plans

All investments carry some level of risk, including the lack of return and/or loss of principal invested.

Got pension plans at another bank? Transfer them to Openbank and start enjoying all our benefits!

Contact our specialists on 91 177 33 16 or 900 22 32 42, Monday to Friday from 8 a.m. to 8 p.m., and they'll handle the arrangements and answer any of your questions.

What pension plans do we offer at Openbank?

These are the most searched plans among investors at Openbank

Asset and sub-asset class

Sector Equity

Return

29.63% in 2024 | 30.73% in 2023,

-24.61% in 2022 | 34.05% in 2021

28.04% in 2020

Asset manager: BBVA PENSIONES, S.A., E.G.F.P.

Depository: BBVA, S.A.

It invests more than 75% in shares that primarily belong to the telecommunications sector and new technologies. It may have more than 30% in non-euro currencies.

Asset and sub-asset class

Global Equity

Return

37.59% in 2024 | 28.13% in 2023,

-20.84% in 2022 | 32.47% in 2021

10.57% in 2020

Asset manager: VidaCaixa, S.A.U. de Seguros y Reaseguros

Depository: Cecabank, S.A

It invests 100% in international equity, i.e., in shares of companies around the world.

Asset and sub-asset class

Money Market

Return

3.14% in 2024 | 2.61% in 2023,

0.09% in 2022 | -0.24% in 2021

-0.71% in 2020

Asset manager: BBVA PENSIONES, S.A., E.G.F.P.

Depository: BBVA, S.A.

It invests 100% of its portfolio in short-term fixed-income assets, both government and corporate bonds. The average duration of the portfolio will be less than 18 months.

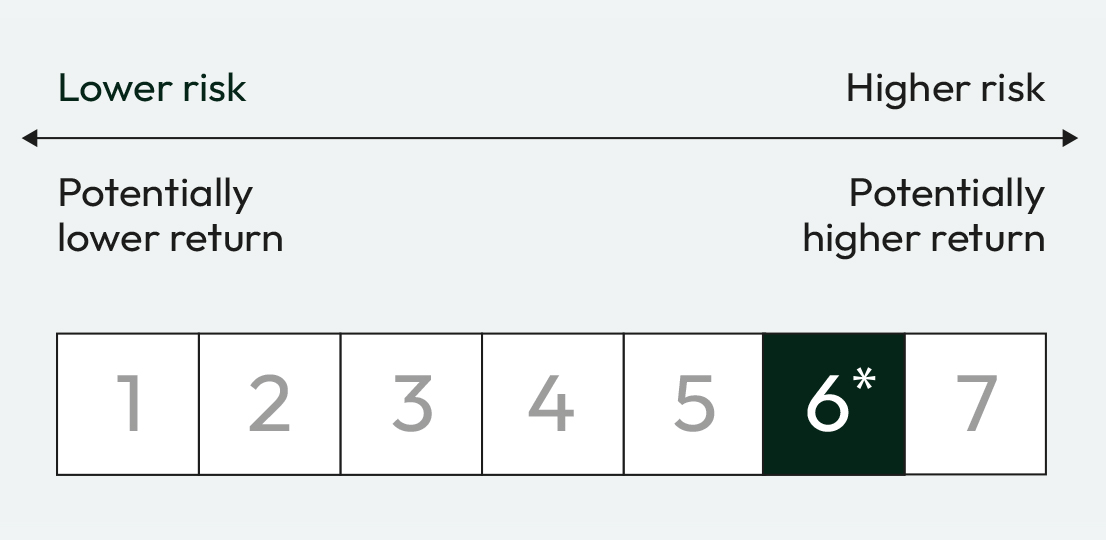

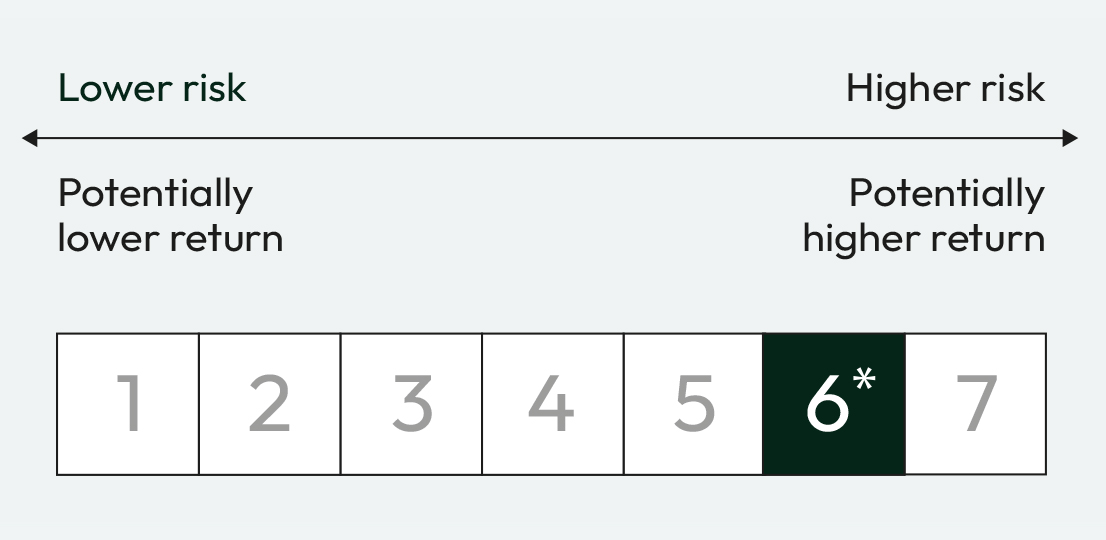

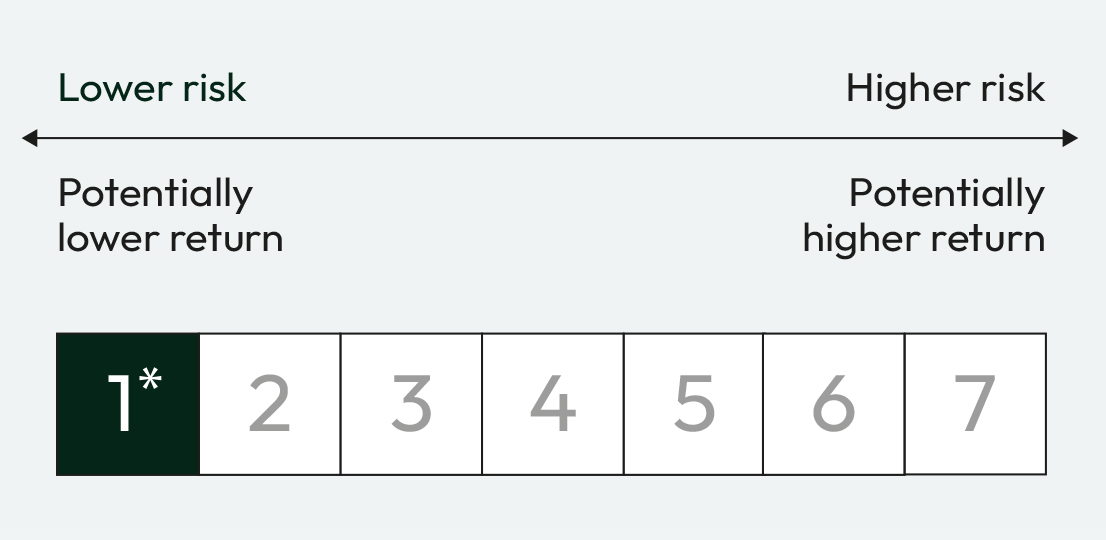

*KID (Key Investor Document) risk scale. Risk rating 1 does not mean a risk-free investment. This indicator may change over time.

Most searched pension plans on the Openbank website in December 2023 (source: Google Analytics). Calendar year return, from 2020 until 2024 (source: Morningstar). The risk-return indicator shows the potential return and risk of the fund, where 1 represents the lowest risk (not exempt from risk) and 7 the highest risk.

The value of the investment is subject to market fluctuations, and past performance is no guarantee of future results.

Prior to investing, please consult the risk rating, fees and information for each of the Pension Plans marketed by Open Bank, S.A., set out in the Prospectus or Key Information Document for each Pension Plan, available in the corresponding page for each plan at www.openbank.es/en.

Liquidity alerts:

Collecting the benefits or exercising the right of redemption is only possible where any of the contingencies or exceptional cases of liquidity provided for in the regulations on pension plans and funds arise.

The value of transfer rights, benefits and exceptional cases of liquidity depends on the market value of the pension fund assets and may lead to significant losses.

1 This amount has been calculated on the basis that an individual is subject to the maximum income tax withholding rate (45%). The tax savings depend on the personal circumstances of each customer and may vary in the future.

Want to learn more about Pension Plans?

What is a pension plan?

It is a savings product to accumulate capital in the long term, which allows you to complement the pension you will receive when you retire.

A pension plan pools the money contributed by a large number of investors (participants), and an asset management firm is responsible for managing it in order to obtain the best possible return by investing in a series of assets, such as shares, bills, bonds, debentures, etc.

The KID (Key Information Document) for the different pension plans that we market can be consulted on the main page for each one of the plans on our website.

How can you transfer your pension plan to Openbank?

To transfer your pension plan at any bank to Openbank, all you have to do is:

Fill out this document, sign it and upload it in the Customer Area of the website.

From your profile select "Documentation". Click "More options" and select "Upload Documentation". Choose the "Investments: Pension Plans" option and upload the required documents.

When we receive your request, we will get in touch with the relevant asset managers to start the transfer process.

If you have any doubts, send us an email to: inversiones@openbank.es or call and speak to one of our specialists on 91 177 33 16.

How much can you invest?

Contributions in excess of €1,500 cannot be made. If you have already set up automatic contributions to your pension plans and their annual sum exceeds €1,500, call us on 91 177 33 16 to adjust them, as they cannot exceed that amount.

At Openbank, we make it simple. You can decide if you want to make automatic contributions from €6 - just indicate how much and how often and we'll take care of the rest.

How can you invest in a pension plan?

Our advanced Pension Plan Finder tool allows you to filter and select from between a wide range of plans, so you can find the pension plan that best suits your needs.

If you would prefer to speak to someone, call us on +34 91 177 33 16 and our team of pension professionals will be glad to help.

If you are not yet a customer, open an account by clicking here.

Work out how much you need to save to earn the same in retirement

Find out how much you need to save each month to reach your desired amount of income for retirement and get tax relief in your next income tax return. Use our calculator to work out your necessary monthly savings to cover a fixed amount when you retire depending on your personal circumstances.

Please note that if your annual contribution to pension plans exceeds €1,500, you will have to allocate a portion of the savings to other products such as investment funds.

What tax advantages do pension plans have?

As of 1 January 2022, the maximum reduction in personal income tax for investment in pension plans is €1,500 (which is the annual maximum that, by law, you can invest in these products), or 30% of your income from work and economic activities, whichever is less. Even so, pension plans are still an interesting complement to your future public pension.

For example, with an annual contribution of €1,500 to your pension plan, and having a marginal rate of 24% in personal income tax, you can save up to €360 on your income tax return*. Take advantage of this benefit and invest in a pension plan - you have over 40 plans to choose from. Don't forget that at Openbank you do not have to pay additional fees, other than those charged by the plan's asset manager.

In addition, for your convenience you can set up automatic contributions.

*The tax savings depend on the personal circumstances of each customer and may vary in the future.

How and when will you get your money back?

You can redeem your pension plan when you retire. Although, you can also withdraw your money in exceptional cases, such as major disability or long-term unemployment, among others. Plus, from January 2025, you will be able to redeem contributions that are least 10 years’ old.

When you cash in your plan, you have four options:

- In the form of capital, i.e., all at once.

- In the form of income, through periodic payments.

- In a mixed form - a specific amount at once and then the rest periodically.

- In the form of sporadic payments, with total flexibility.

Need more information?

We make it simple. Get in touch with our specialists on 91 177 33 10 Monday to Friday from 8 a.m. to 8 p.m. and they'll be glad to help.

We make it simple. Give us a call on 91 117 33 16 or 900 10 29 38 and our team of investment specialists will be happy to help (Mon-Fri 8 a.m. to 8 p.m.).

Find us on: